Emerging Technologies in Photogrammetry Software Market | Forecast to 2035

Mergers and acquisitions (M&A) have become a pivotal and highly strategic force in shaping the competitive landscape of the global photogrammetry software market, serving as the primary mechanism for major technology companies to acquire cutting-edge capabilities and to vertically integrate their platforms. A strategic analysis of the most significant Photogrammetry Software Market Mergers & Acquisitions reveals a clear pattern: large platform companies in adjacent industries, such as gaming and AEC (Architecture, Engineering, and Construction), are acquiring best-in-class, independent photogrammetry software providers to make reality capture a seamless, native feature of their own massive ecosystems. This M&A activity is a direct reflection of the growing strategic importance of "digital twins" and photorealistic 3D content. The Photogrammetry Software Market size is projected to grow USD 19.54 Billion by 2035, exhibiting a CAGR of 18.2% during the forecast period 2025-2035. This expansion and the high strategic value of the technology have fueled a dynamic M&A environment where leading photogrammetry firms have become highly attractive acquisition targets, leading to a major consolidation and re-shaping of the industry.

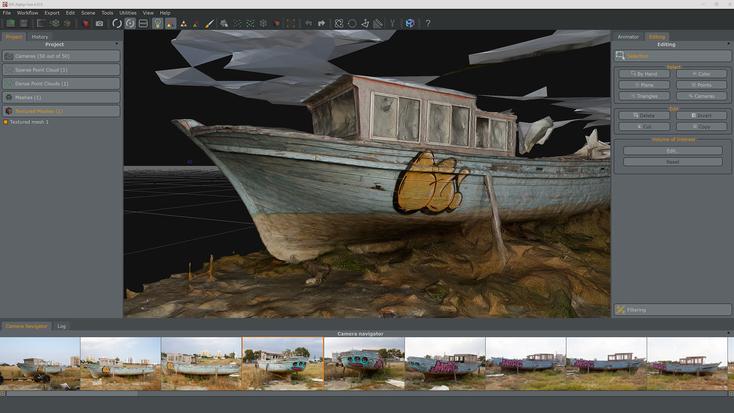

The most transformative M&A deal in the history of the photogrammetry market was the acquisition of Capturing Reality, the developer of the highly-acclaimed RealityCapture software, by Epic Games, the powerhouse behind the Unreal Engine and Fortnite. This was a strategic masterstroke that sent shockwaves through both the gaming and the reality capture industries. Epic's strategy was to acquire what many considered to be the fastest and highest-quality photogrammetry processing engine on the market and to integrate it deeply into its Unreal Engine platform. The goal is to make it incredibly easy for game developers and virtual production studios to scan real-world objects and environments and to bring them into the engine as photorealistic, game-ready assets. This move dramatically lowers the barrier to creating high-fidelity 3D content and provides Epic with a massive competitive advantage. It also effectively removed a major independent player from the market and turned its technology into a feature of a larger platform, a classic example of M&A-driven consolidation.

This pattern of acquisition by larger platform players is not unique to the gaming industry. The major AEC and geospatial software companies have also been active acquirers. Bentley Systems, a leader in infrastructure software, has made acquisitions of photogrammetry and reality modeling companies to build out its ContextCapture offering, which is a key component of its "digital twin" strategy for large-scale infrastructure projects. Autodesk has also used acquisitions and in-house development to build its ReCap reality capture platform, which is designed to provide a seamless workflow for bringing point cloud and photogrammetry data into its core design applications like Revit and Civil 3D. Looking forward, M&A is likely to continue, with the remaining successful independent photogrammetry software providers being potential targets for other major technology companies looking to build out their own 3D and metaverse capabilities. We may also see acquisitions focused on companies with specialized AI-powered technology for automating and improving the photogrammetry workflow, such as AI for semantic segmentation of 3D models or for automated object recognition.

Top Trending Reports -

US Outsourced Software Testing Market

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spiele

- Gardening

- Health

- Startseite

- Literature

- Music

- Networking

- Andere

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness